What We Do

When CFS was founded, we launched 5 flagship projects with it. These 5 projects round up the work that we continue to do at CFS:

1. Research

We have undertaken and published multidisciplinary research into the aims, practice and consequences of taxes which affect taxpayers, and governments. Our research has produced insights and policy proposals and advocacy strategies on curbing illicit financial flows, achieving fiscal transparency and accountability, identifying problematic tax norms and legal provisions in tax treaties, and tax legislation.

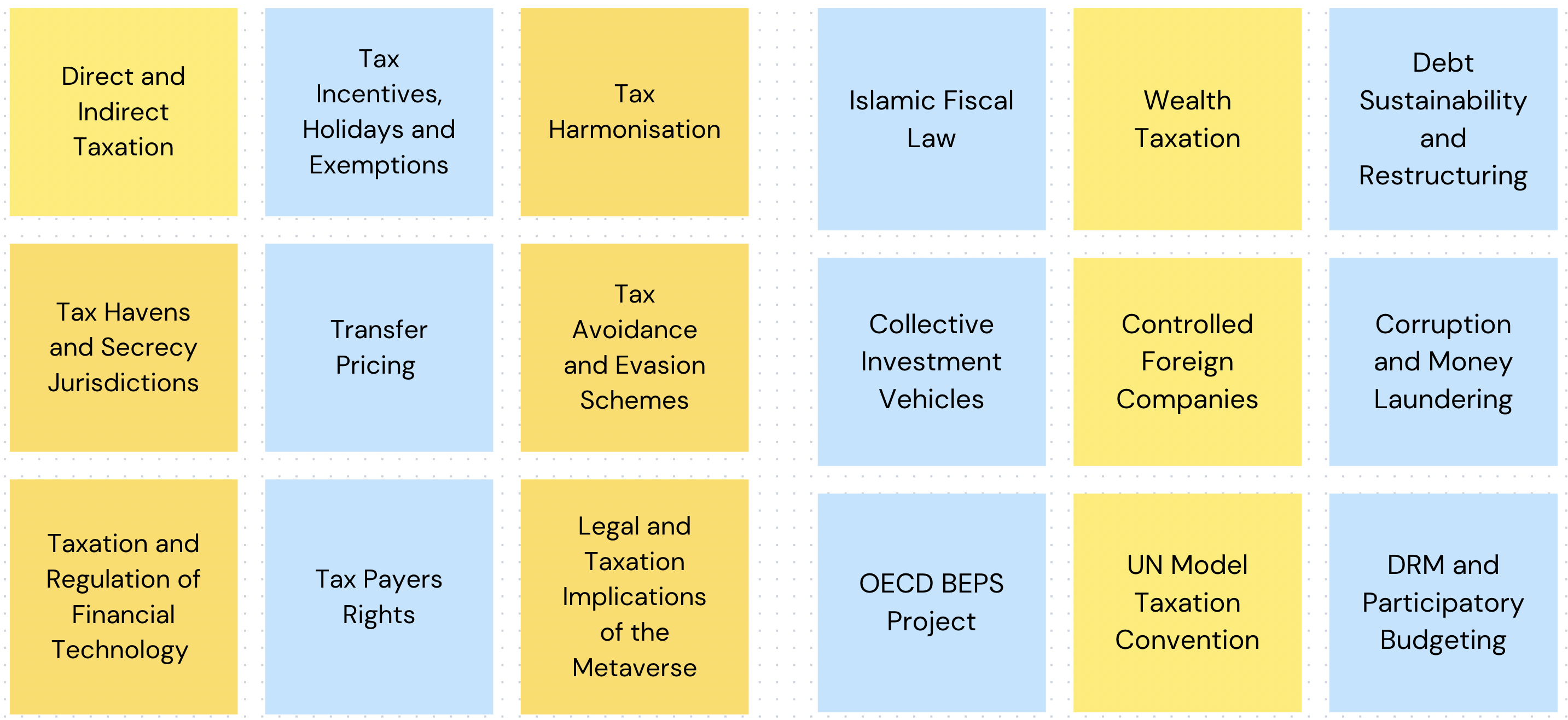

Specifically, we focus on:

2. Tax Training and Capacity Building Programs

At CFS we believe in strengthening the understanding of state and non-state actors in the global south on the law, economics and politics of taxation and its interlinkages with structuring society, influencing international tax norms and development spending. We are of the view that tax policies are not formulated to only provide businesses with predictability but also to give certainty to citizen taxpayers that spending will prioritise every citizens’ progress towards enjoying their human rights and benefiting from internationally agreed goals for human development. Towards this effect, Our Tax Training and Capacity Building Programs are designed to lead to fostering the development of a strong tax state.

3. Influence and Intervention

Our efforts in training and building capacity are key to how we influence and intervene in international decision making circles where policies impacting national and cross border taxation are formulated. Our CFS members since 2018 have been attending international meetings where policies steering international tax norms are negotiated. You can read more about our Impact here

4. Mentorship Program

We invite all students, globally, to apply to Our Mentorship Program. As the program launches our mentees bring their ideas about goals and objectives they would like to accomplish and their paired mentor then begins providing guidance, sharing professional development experience and participate in candid conversations intended to build confidence, trust and we hope, a lasting relationship. Our mentees are trained on writing blogs, policy briefs, research papers, journal articles and designing primers. They are given an opportunity to moderate webinars, give a talk, assist on our training courses and shadow CFS Leadership.

5. Publications

The Journal on Financing for Development is a double blind peer reviewed, open-access publication. Its text is accessible to the visually impaired. The inaugural issue was launched by Lyla Latif in 2019. Since then the journal has been gaining prominence. It has a strong Editorial Advisory Board and a Strategic Advisory Panel. The purpose of the journal is to spotlight African scholarship on themes relating to fiscal law and policy by Africans and also others whose scholarship focuses on Africa.

CFS has been generating practical guidance for governments, tax administrators and taxpayers to help strengthen fiscal systems with a view to mobilising finances for inclusive and sustainable development. With a view to enhancing, promoting and influencing international taxation and fiscal policy making, CFS invites authors to write policy briefs that cover any theme related to taxation and specifically on:

- Providing a framework to enhance and promote international tax cooperation among national tax authorities

- Consider how new and emerging issues can affect international cooperation in tax matters

- Make recommendations on capacity building giving special attention to African countries

- Contribute to the development of SDG oriented fiscal policies to raise revenue to finance sustainable and inclusive development, reduce inequality and promoted inclusive growth.