CFS Diaries

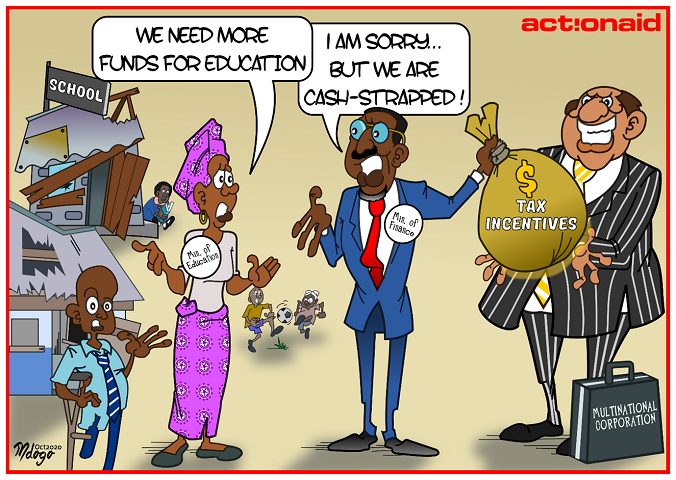

1. The Challenges of Imposing a Wealth Tax in Africa

Wealth inequality is a growing problem in Africa, with a small percentage of the population holding a significant proportion of the wealth. One potential solution to address this issue is the implementation of a wealth tax. A wealth tax is a taxation mechanism that taxes the net worth of individuals and corporations. While it has the potential to redistribute wealth and promote income equality, there are several challenges to imposing a wealth tax in Africa. Here we explore some of these challenges:

- Limited Data: One of the primary challenges of imposing a wealth tax in Africa is the limited data on the wealth of individuals and corporations. African countries often lack accurate data on the wealth of their citizens, making it difficult to assess the tax base and determine the appropriate tax rate. Without accurate data, it is challenging to implement a wealth tax effectively.

- Tax Evasion: Another challenge is the potential for tax evasion. Wealthy individuals and corporations may seek to evade the tax by hiding their assets, transferring them to other jurisdictions, or underreporting their wealth. This makes it difficult for tax authorities to enforce the tax effectively. This challenge can be particularly significant in countries with weak governance structures, where corruption is prevalent.

- Brain Drain: Wealthy individuals may choose to leave the country rather than pay the wealth tax, leading to a "brain drain" of talent and resources. This can have negative effects on the country's economy and development. Losing talented individuals can have long-term effects on the country's ability to attract investment and grow the economy.

- Disincentive for Investment: Imposing a wealth tax may discourage investment and entrepreneurship. Wealthy individuals may be less inclined to invest in the country if they perceive the tax as a disincentive to wealth creation. In the long run, this can hinder the country's economic development and reduce opportunities for job creation.

- Administration Costs: Implementing a wealth tax requires significant administrative resources, which may be lacking in many African countries. Tax authorities may need to invest in additional staff and infrastructure to assess, collect and enforce the tax. This can be challenging for countries with limited resources.

- Legal Challenges: Imposing a wealth tax may also face legal challenges. Wealthy individuals may challenge the tax in court, claiming that it is unconstitutional or violates their property rights. Legal challenges can be lengthy and expensive, and they can further delay the implementation of the tax.

Conclusion: While a wealth tax may be an effective mechanism for redistributing wealth and promoting income equality, it is not without its challenges. African countries would need to address these challenges to implement the tax effectively and achieve the desired results. It would require accurate data, effective enforcement mechanisms, and balancing the tax's impact on investment and entrepreneurship. Additionally, addressing the root causes of wealth inequality, such as creating a more inclusive and equitable economy, could be an alternative solution to the problem. While a wealth tax may be a viable solution in some contexts, African governments need to carefully consider the challenges before implementing the tax.

2. Achieving Economic Development in Africa Through Progressive Taxation

Africa has been facing many challenges to achieving economic development, and the issue of generating sufficient revenue to fund development plans and public services remains one of the biggest challenges. However, one solution that has been overlooked is the implementation of a progressive tax system. A progressive tax system is a taxation mechanism where the tax rate increases as the income or wealth of an individual or corporation increases. This system has the potential to promote income equality, fund social programs, and reduce reliance on external borrowing and debt.

Benefits of a progressive tax system: One of the primary benefits of a progressive tax system is that it promotes income equality. In many African countries, there is a vast disparity in income levels, with a small percentage of the population earning a significant proportion of the wealth. A progressive tax system can help reduce this gap by taxing the wealthiest individuals and corporations at a higher rate. This mechanism helps generate revenue to invest in education, healthcare, infrastructure, and other public services that can improve the quality of life for citizens and promote economic growth. Another advantage of a progressive tax system is that it can generate revenue to fund social programs that benefit the most vulnerable in society. African countries face many social challenges, including high levels of poverty, inadequate healthcare, and inadequate education systems. Through a progressive tax system, governments can fund programs that address these issues, promote social justice, and create a more sustainable and inclusive economy. A progressive tax system can also help reduce reliance on external borrowing and debt. Many African countries have significant external debt burdens, which can limit their ability to invest in public services and infrastructure. By implementing a progressive tax system, governments can generate revenue to fund these investments without relying on external borrowing.

Challenges of implementing a progressive tax system: Implementing a progressive tax system is not without challenges. One of the primary challenges is the need for strong political will and effective tax administration. Governments must have the political will to implement the system and the capacity to administer it effectively. This requires investing in tax administration systems, simplifying the tax system, increasing transparency, and reducing corruption. Another challenge is the need for citizen support. Citizens must understand the benefits of a progressive tax system and be willing to comply with the tax laws. Governments must, therefore, engage citizens and educate them on the benefits of the system and how it works.

Conclusion: A progressive tax system has the potential to help African countries achieve economic development without reliance on debt. It can promote income equality, fund social programs, and reduce reliance on external borrowing. However, implementing a progressive tax system requires strong political will, effective tax administration, and citizen support. It is, therefore, essential for African governments to invest in these areas to achieve the full potential of the progressive tax system. By doing so, African countries can create a more sustainable and inclusive economy that benefits all citizens.

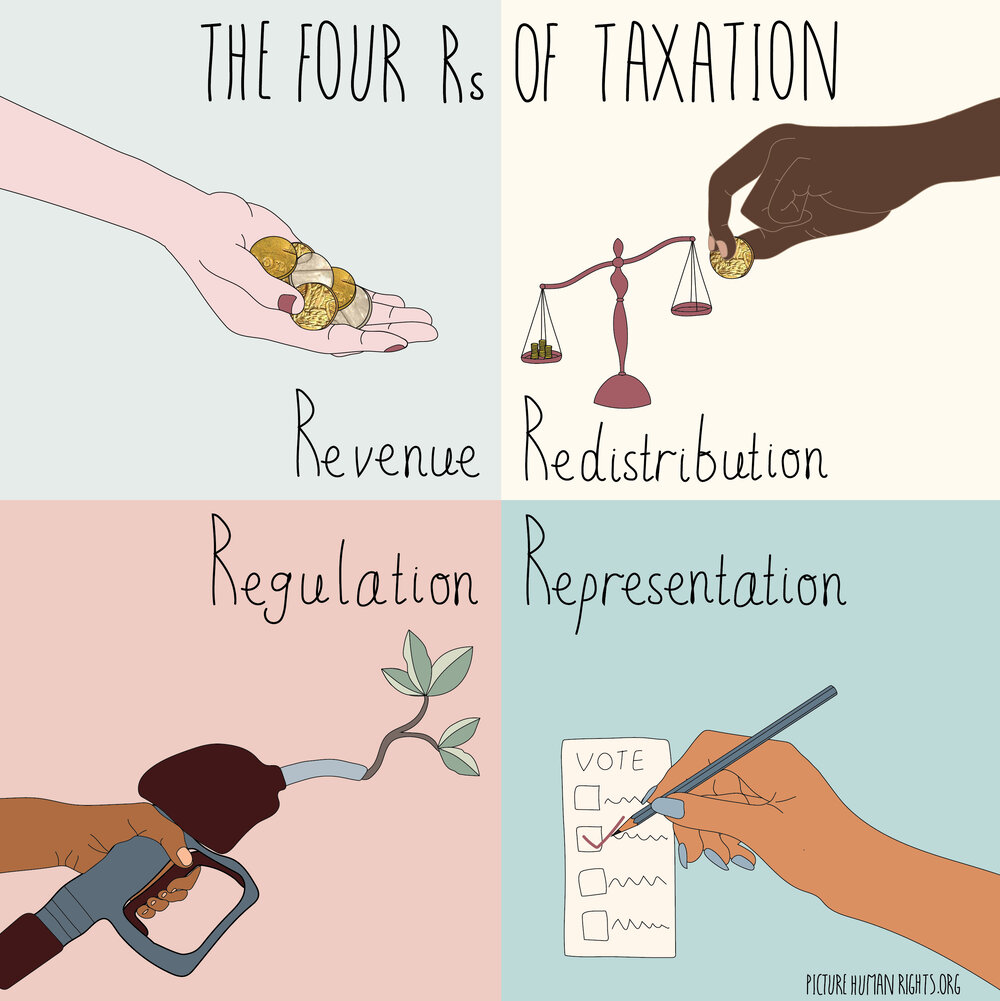

3. Taxation as a Human Right: Financing Equitable and Accessible Healthcare

Access to quality healthcare is a fundamental human right that is essential for the well-being of individuals and societies. However, financing healthcare services can be expensive, and many countries struggle to provide adequate funding. This is where taxation comes in. Taxation is a powerful tool that governments can use to finance healthcare services and ensure that everyone has access to the care they need.

What is Taxation as a Human Right? Taxation as a Human Right is the recognition that the right to healthcare is dependent on a state's capacity to raise revenues through progressive taxation. It means that everyone should contribute to financing healthcare services according to their ability to pay. The concept of Taxation as a Human Right promotes distributive justice and helps to ensure that the burden of financing healthcare is shared fairly across society.

Why is Taxation as a Human Right important for healthcare? Healthcare is a public good that benefits everyone, regardless of their income or social status. However, financing healthcare services can be expensive, and many people are unable to access the care they need. Taxation provides a means for governments to raise revenue and finance healthcare services. Furthermore, progressive taxation can help to promote distributive justice by ensuring that those who earn more contribute a larger share of their income to financing healthcare.

What are the benefits of Taxation as a Human Right? Taxation as a Human Right promotes distributive justice and ensures that the burden of financing healthcare is shared fairly across society. It also helps to ensure that everyone has access to the care they need, regardless of their income or social status. Taxation as a Human Right also helps to promote the accountability of governments, as they are responsible for providing adequate funding for healthcare services.

How can Taxation as a Human Right be implemented? Governments can implement Taxation as a Human Right by:

- Implementing progressive taxation systems that ensure that those who can afford to contribute more do so.

- Increasing public funding for healthcare services to ensure that everyone has access to the care they need.

- Combating tax evasion and avoidance, which drain public resources and undermine the provision of essential public services, including healthcare.

- Encouraging international cooperation to combat tax havens and other forms of illicit financial flows. This can help to ensure that public resources are not drained away from healthcare and other essential services.

Conclusion: Taxation as a Human Right is a powerful concept that promotes distributive justice and ensures that everyone has access to quality healthcare. By implementing progressive taxation systems, increasing public funding for healthcare, combating tax evasion and avoidance, and encouraging international cooperation, governments can ensure that everyone has access to the care they need, regardless of their income or social status. Taxation as a Human Right helps to build a more just and equitable healthcare system that benefits everyone.

4. The Challenge of Taxation and Jurisdiction in the African Metaverse

The metaverse is an exciting and rapidly emerging digital world that is attracting attention from all over the world, including in Africa. The metaverse is essentially a virtual world that has the potential to transform the way we live and work, but it also raises important questions around taxation and jurisdiction.

As the metaverse is an entirely virtual world, it creates unique challenges for taxation and jurisdiction. Currently, most tax laws in countries are designed to apply to physical goods and services, and it's unclear how tax laws will apply to virtual goods and services in the metaverse. This is a significant issue for African countries, where tax collection is already a challenge due to the informal economy and high tax evasion rates.

One potential solution for African countries is to create new tax laws that specifically apply to virtual goods and services in the metaverse. This would require careful planning and coordination, but it could be a way to ensure that taxes are collected on the profits generated by businesses operating in the metaverse. Another significant challenge for African countries in the metaverse is jurisdiction. As the metaverse is a global virtual world, it's not always clear which country's laws would apply in the event of disputes or criminal activity. This creates an enormous challenge for African countries that need to protect their citizens in the metaverse.

One possible solution for African countries is to work together with other countries to create a set of global laws that apply to the metaverse. This could involve creating an international court system that has jurisdiction over disputes and criminal activity in the metaverse. This would require significant coordination and cooperation, but it could be a way to ensure that African citizens are protected in the metaverse.

In conclusion, the metaverse is a rapidly emerging digital world that has the potential to transform the way we live and work. However, it also presents significant challenges around taxation and jurisdiction, which will need to be addressed by African countries in the coming years. By creating new tax laws and collaborating with other countries to establish global laws, African countries can ensure that their citizens are protected in the metaverse.

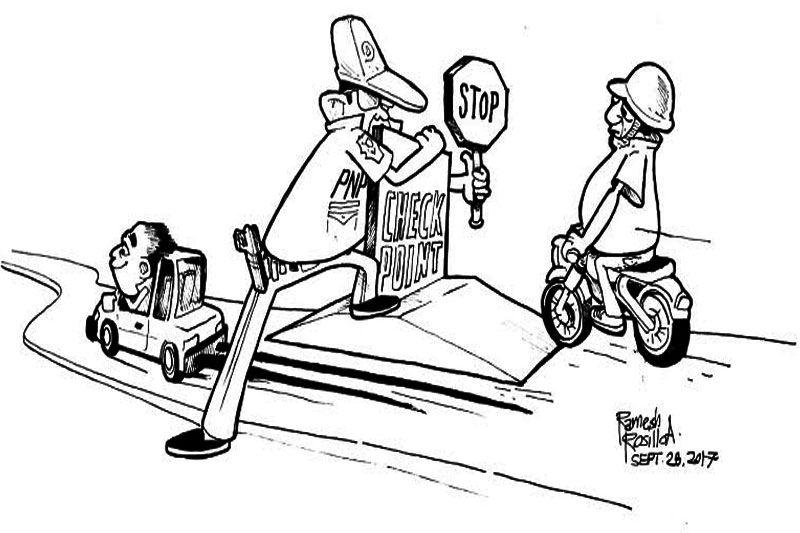

5. The Evolution of Checkpoint Taxes: From Roadside Extortion to State Revenue

In many conflict zones around the world, armed rebel and insurgent groups often impose ad hoc taxes on travellers passing through makeshift roadway checkpoints. These checkpoint "fees" act as an unauthorized taxation system that allows non-state actors to generate income and assert control over territories. However, what happens to these informal checkpoint taxes when the armed group gains official governing power?

One example is the Taliban's use of checkpoints in Afghanistan prior to their return to power in 2021. As insurgents, the Taliban erected checkpoints on major highways and roads to stop convoys and impose arbitrary duties on goods being transported. These funds would go towards financing the Taliban's operations and administration needs. The arbitrary nature of the taxes also undermined the Afghan government's authority.

However, with the Taliban's takeover of the state apparatus, there has been a transition in checkpoint taxation practices. Instead of improvised checkpoints with ad hoc fees, there is now an effort to formalize checkpoint taxation into an official state revenue source. Rates are standardized, procedures established, and revenues fund the new government's budget.

This shift reflects a broader pattern: armed groups employ informal taxation methods before taking power, which then become institutionalized under their official governance. Extractive checkpoints transform into tools for monitoring trade flows, projecting state authority, and financing public spending.

However, risks remain that those in power will prioritize accumulating personal wealth and cementing their control, rather than equitable development and citizen well-being. Checkpoint taxes lend themselves more easily to extortion than progressive income taxes. And a history of exploitative informal taxation can undermine public trust in the state's new formalized tax system.

Therefore, successful transitions towards legitimate checkpoint taxation require commitments to accountability, inclusive governance and equitable revenue distribution. Checkpoint taxes may persist as a fiscal reality in conflict-affected regions, but transforming them into stable funding for peace, development and good governance remains an ongoing challenge.