TAX BREAKS: An Economic Boost or a Fiscal Burden?

By Parita Shah (Ph.D) - Senior Lecturer, Department of Geography, and Population and Environmental Studies, University of Nairobi

World over, tax breaks have increasingly taken center stage in discussions surrounding tax equity, fiscal responsibility, and the role of governments in promoting economic and social well-being. These incentives, which are also referred to as tax credits, deductions or exemptions, are designed to reduce the tax burden on individuals or businesses. These benefits are provisions in the tax code and are often offered by governments to encourage certain behaviours that support broader policy goals, such as boosting investment in specific sectors that are designed to contribute to national development, promoting charitable donations, or advancing sustainability through energy efficiency initiatives.

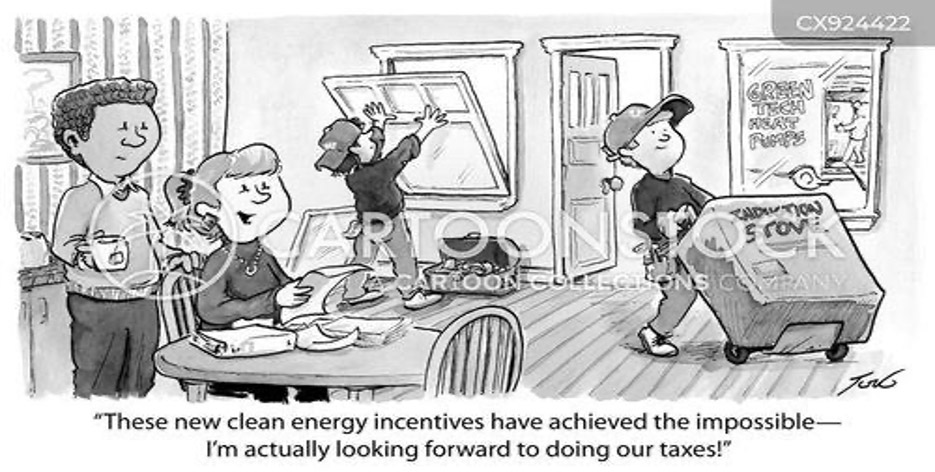

Tax breaks play a crucial role in fiscal policy, acting as tools to stimulate economic growth and investment. Beyond their economic impact, tax breaks can also bring significant social benefits to a country. They can support low-income families, strengthen education systems, and contribute to healthcare funding. Moreover, tax credits can incentivize environmentally sustainable practices and foster innovation, particularly in research and business expansion. By providing these incentives, governments not only drive growth but also enhance tax compliance, as individuals and businesses come to understand and value the benefits of these reductions.

Understanding the Use of Tax Breaks

Tax breaks are widely used as a tool to help individuals and businesses manage their financial obligations, incentivize desired behaviours, and promote social welfare. These benefits can have a direct impact on a person’s or businesses’ financial situation, often making taxes more manageable and encouraging productive economic actions.

For example, mortgage interest deductions are a common form of tax breaks in many countries. When individuals buy a house/home, the interest they pay on their mortgage is deducted from their taxable income. This reduced the amount of tax owed, and this eventually makes home ownership more affordable for individuals. Similarly, student loan interest deductions work the same way, and this in turn eases the financial burden on borrowers by reducing the taxable income based on the interest paid on educational loans. The motive is to encourage people to pay taxes even in small amounts without feeling the pinch of their other payments, obligations or philanthropic decisions. The developed world encourages its people to pay tax, but in reduced amounts through this mechanism.

Charitable donations are also another form of tax breaks commonly employed by governments to encourage philanthropy. Whenever some individuals or corporations donate to recognized charitable organizations, the amount donated can be deducted from their taxable income. This kind of deduction creates a dual benefit - where on one part it helps individuals save on taxes, and on the other part it supports social causes and community welfare. This system is especially prevalent in developed economies, where the goal is to increase compliance with tax obligations by reducing the burden through various forms of tax incentives.

Family-related tax breaks are also significant in many countries. For instance, some nations offer tax deductions or credits to families with children, aiming to reduce the financial strain on new parents. These breaks can help families afford essentials like nutritious food, medical care, and quality education. By alleviating these costs, governments hope to create a more supportive environment for raising children, ultimately contributing to healthier, better educated, and more productive future generations. Such incentives are particularly useful in the context of countries experiencing demographic shifts and declining birth rates, as they provide a direct financial incentive to families. Moreover, some tax credits target social causes, such as child adoption. In various countries, families who adopt children are eligible for tax credits, which help offset the financial challenges of adoption. These credits encourage the expansion of families while alleviating the burden on state-run child welfare programs. By promoting adoption, governments reduce reliance on foster care and ensure better care for children who may otherwise remain in institutionalized settings.

In addition to individual benefits, tax breaks are also used to promote corporate and environmental goals. Many companies in the U.S and in Europe now benefit from tax credits for businesses investing in renewable energy or other sustainable practices. For businesses, these tax credits reduce operating costs and provide a tangible financial benefit for adopting green technologies, which can lead to long-term cost savings and environmental impact reduction.

Tax exemptions are another important category of tax breaks. Certain individuals and charitable organizations, such as churches and non-governmental organizations (NGOs), are often granted exemptions from taxes. In Kenya, for example, religious institutions and NGOs are typically exempt from paying taxes on income, which allows them to reinvest their funds into community services. Similarly, tax exemptions may apply to people with disabilities, as seen in Kenya’s Disability Act of 2003, which exempts individuals with disabilities from paying taxes on income up to a certain threshold (currently it is at Kshs. 150,000). These exemptions aim to reduce financial barriers for vulnerable groups, ensuring that essential services and support systems remain accessible to those who need them most.

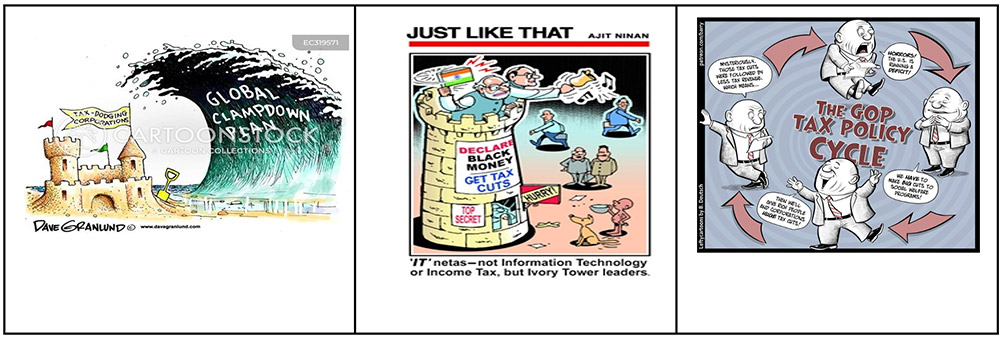

Abuse and Misuse of Tax Breaks

While tax breaks are intended to incentivize positive economic behavior and provide financial relief, they are often exploited by individuals and corporations seeking to minimize their tax liabilities unfairly.

One common form of abuse involves the use of loopholes in tax laws. For example, multinational corporations may engage in transfer pricing, where they shift their profits to low-tax jurisdictions to reduce their overall tax burden. Similarly, some companies use complex financial structures to move profits to tax havens, which in turn reduces their taxable income in higher-tax countries.

Another frequent misuse of tax breaks occurs in the area of charitable deductions, where individuals or businesses may overvalue donated goods or create sham charities to claim excessive deductions. In some countries, real estate investors exploit depreciation rules or other deductions to minimize taxes on rental income or capital gains. Wealthy individuals may also exploit tax breaks meant for homeownership, purchasing multiple properties for investment purposes, driving up housing prices, and further distancing homeownership from lower-income groups.

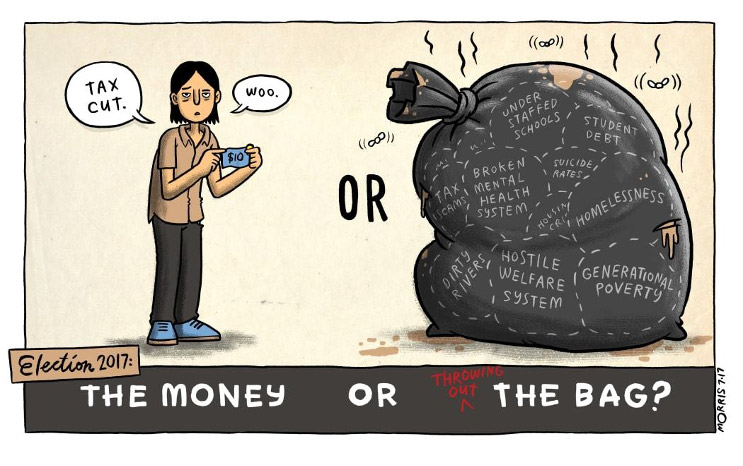

Tax breaks are often seen to disproportionately benefit wealthier individuals and corporations, exacerbating economic inequality. Deductions for things like mortgage interest or retirement savings tend to favor those who can afford to invest in property or save for retirement, leaving low-income individuals with limited benefits. Moreover, some industries and companies lobby for tax breaks tailored specifically to their interests, distorting markets and creating an uneven playing field that serves private rather than public interests. This can distort markets and create an uneven playing field.

Excessive or poorly designed tax breaks can lead to a significant reduction in government revenue, ultimately compromising the funding of essential public services like education, healthcare, and infrastructure. As the proliferation of tax breaks increases, tax systems can become overly complex, leading to higher compliance costs for taxpayers and administrative burdens for governments. This complexity can also create new opportunities for abuse and further exacerbate inequalities.

Moreover, tax breaks are sometimes granted to companies and individuals with unreported wealth or black money. This situation perpetuates a cycle of inequality, where the wealthy continue to accumulate more resources without contributing their fair share to public services. The ease of declaring illicit or undeclared wealth through loopholes diminishes the integrity of the entire tax system.

So, are tax breaks an economic boost or a fiscal burden?

Ultimately, the effectiveness of tax breaks hinges on their careful design and implementation. When structured properly, they can stimulate economic growth, encourage investment, and provide financial relief to individuals and businesses. However, if left unchecked or poorly designed, tax breaks can lead to unnecessary complexity in the tax system, making compliance more burdensome for taxpayers and increasing administrative costs for governments. This complexity can also create loopholes that are exploited by those seeking to minimize their tax liabilities unfairly.

Moreover, without proper oversight, tax breaks can disproportionately benefit the wealthiest individuals and corporations, exacerbating income inequality. Instead of promoting widespread economic development, they may concentrate wealth in the hands of a few, while leaving lower-income groups with limited benefits. This not only deepens economic disparities but can also undermine the public sector, as excessive tax breaks result in revenue loss, limiting governments' ability to fund essential public services like education, healthcare, and infrastructure.

Therefore, tax breaks should be carefully designed to strike a balance: promoting growth and investment, reducing inequality, and ensuring that governments can still generate sufficient revenue to support public welfare. If not managed well, tax breaks can easily become a fiscal burden, undermining social equity and long-term economic development.

Authors Note: This blog was written by Parita Shah (Ph.D), who is a member of KNAS, and a Senior Lecturer in the Department of Geography, Population and Environmental Studies at the University of Nairobi